Set Up Manual Tax Rates in Squarespace: A Step-by-Step Guide

Manual Tax Rate Setup in Squarespace

Sales tax collection in Squarespace depends on the customer's location:

- Shipping address for physical products

- Billing address for digital products and services

- Member's billing postal code for memberships

- Tax doesn't apply to donations or gift cards

Adding Country Tax Rates:

- Open the Taxes panel

- Click "Add Rate" under Manual Setup

- Select country and state (if US)

- Enter tax name and rate

- Toggle options for services/digital products and shipping

- Save changes

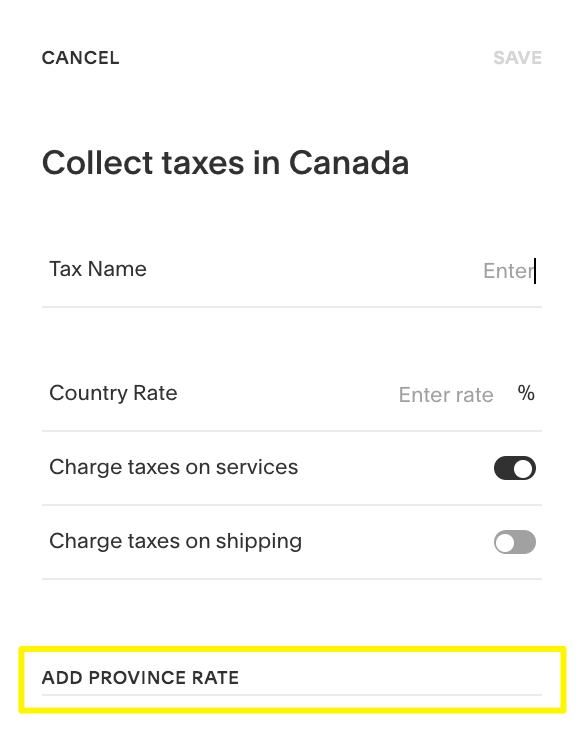

Adding Canadian Province Rates:

- Click "Add province rate"

- Select province

- Enter provincial tax rate

- Configure tax options

- Click Add, then Save

Add province tax

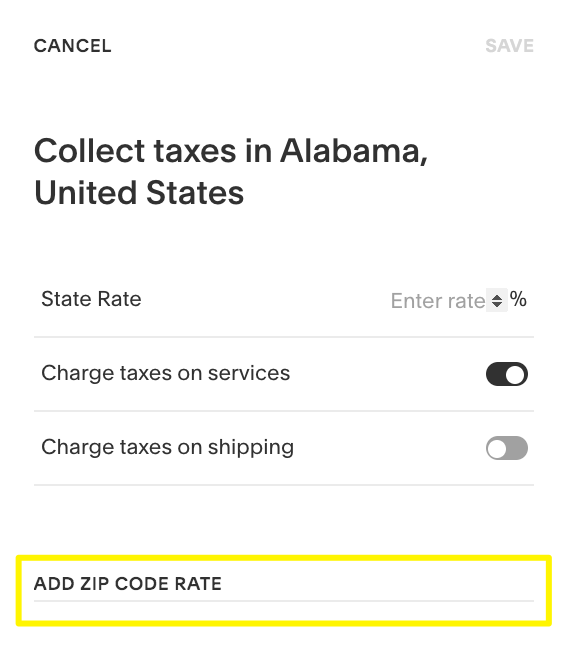

Adding US Local Tax Rates:

- Click "Add zip code rate"

- Choose ZIP Range or Single ZIP Code

- Enter ZIP code(s) and tax rate

- Click Add, then Save

ZIP code rate calculator

Additional Features:

- Tax-inclusive pricing available (product price includes tax)

- Multiple tax rates combine (not compound)

- Edit/remove tax rules through Taxes panel

- Taxes calculate on discounted prices

Important Notes:

- Cannot set different rates per product

- Cannot set city/region rates outside US/Canada

- Cannot exempt specific customers

- State tax rates combine with local rates

- Removing country tax rules removes all associated state/local rates

For US Sellers:

- Consider economic sales tax nexus laws (South Dakota v. Wayfair)

- Consult tax advisor for compliance

- Check state-specific tax requirements

- Use automatic tax rates via TaxJar for simplified US tax management

Related Articles

How to Connect a Squarespace Domain to Your Website